Information on valuation, funding, cap tables, investors, and executives for Auquan Use the PitchBook Platform to explore the full profileAuquan Toolbox is the best open source tool for institutional investors to use to build their trading strategies Built by some of the worlds leading quants, so you can focus on delivering alphaBuild a Model Translate your ideas using any method you like into predictive models Make a Submission Upload your submission file for realtime backtesting and evaluation Get on the Leaderboard Improve on

Auquan Holmes Hudl

Acquainted

Acquainted-Auquantoolboxpython Public archive Backtesting toolbox for trading strategies DEPRECATED Python 110 55 auquantoolbox Public Backtesting toolbox for trading strategies Python 77 28 samplestrategies Public Sample trading strategies using price data and conventional indicators Python 11 auquanhistoricaldata Public Historical data used by the Auquan backtestingWhat Auquans Have Visited This Page?

150sec

Auquan's AI tools enable hedge funds and asset managers to turbocharge their investment workflows with datadriven insights Our Portfolio Activity Monitor helps funds deal with information overload as they struggle to find insights in 38 million terabytes of unstructured data that exists today We use Natural Language Processing and our proprietary Knowledge Graph to help Chandini Jain is the CEO and founder of Auquan She has 6 years of global experience in finance She started her career with Deutsche Bank Mumbai/New York and worked as a derivatives trader with Optiver, world's largest marketmaker, in Chicago and Amsterdam from 1316 Since 17, she has been working on Auquan, an early stage Auquan Blog Search our insights Search our insights Subscribe Home Trends Using PAM to quickly form an opinion from large unstructured datasets by Chandini Whilst there have been many obvious consequences of the policy response to COVID19 (increase telecommunication and suppression of the hospitality sector), these themes are accordingly well

About Auquan Developer of an algorithmic trading skills platform intended to discover and implement newer trading ideas The company's platform develop high quality trading strategies and bridge the gap between data science and finance, enabling clients to translate analytical skills of talented people into trading profitsCompany information, business information, directors/partners details and director/partners contact information of AUQUAN INDIA PRIVATE LIMITEDAuquan is the portfolio manager's data science platform – we enable you to reinforce your existing investment decisions with data driven insights Solutions are across the entire investment workflow, and depending on where you are in adopting data science, Auquan can help in three stages Getting you comfortable with using data we combine

Author Auquan – auquancom Auquan is releasing its Portfolio Activity Monitor (PAM) following the tool's successful trial run with top global investment firms The software quickly gleans insights from massive amounts of unstructured data, giving portfolio managers the most crucial bits of information without forcing them to spend countless hours sifting through a Auquan is currently a team of 5 engineers and the number is expected to grow to 10 We have a MERN (MongoExpressReactNode) stack and so far as a seed stage startup we Read more in auquanAuquan translates complex financial problems from the fund management industry into mathematical challenges that its network of 10,000 independent data scientists can solve Londonbased Auquan provides access to more data science talent than any single fund could ever hope to hire and has already significantly improved the performance of some of the world's biggest

Auquan Holmes Ridge Point Hs Missouri City Tx Maxpreps

Artificial Intelligence In Trading Market To Demonstrate Spectacular Growth By 26 Aitrades Kavout Auquan Icrowdnewswire

Artificial Intelligence in Trading Market To Demonstrate Spectacular Growth By 26 Aitrades, Kavout, Auquan Date PM"Auquan's quantitative research helped us understand the alpha signals in our data better They uncovered hidden relationships within the data that allowed us to increase our investment strategy's predictive power" Sr MultiAsset Portfolio Manager Swiss Asset Manager $500bn Assets Under Management "Auquan made my investment process quantamental creating newLes derniers tweets de @_Auquan

Portfolio Activity Monitor By Auquan Discover News And Investment Insights Ahead Of The Market Product Hunt

Auquan Delhi India Startup

Auquan is transforming investment research, using knowledge graphs, to simultaneously reduce research time from weeks to hours, while expanding the overall data coverage available toWelcoming Auquan to Episode 1 Maths puzzles 10,000 data scientists = power to beat financial markets In the last few years, data scientists have stepped into the spotlight as modernday superheroes Whether we realise it or not, the work of data scientists lies behind most of our daily experiences From the flights we take, to the food we eat, to the buildings we sit in, to how ourAn Annual Report is a document produced by all companies with shareholders The report details

Chandini Jain S Email Phone Auquan S Founder And Chief Executive Officer Email

Auquan Archives The Desk Fixed Income Trading

Building Auquan Join the discussion as we share with you what we are doing to build the future of data science Recent Topics 2 2 About Building Auquan By David 2 years ago Building Auquan September 19 By David 2 years ago Competitions Posts Topics Practice Problem QuantQuest III Here is a discussion for the Practice Problem QuantQuest III Feel free to post about Auquan Recently graduated from Techstars London, Auquan is a platform to crowdsource datadriven trading strategies from a community of data scientists, developers, and machine learningWe are excited to announce that Auquan is launching a new referral system This new system will allow you to be rewarded for inviting people onto our competition, who later go on to win prizes Read more Finance Annual Reports – Getting Started What is a company's Annual Report?

Working At Auquan Glassdoor

Search Our Insights

Auquan 1,860 followers on LinkedIn Transforming investment research using knowledge graphs Capital Markets are drowning in data there is too much to digest and too many tools to analyse Not all of them can be looked at manually As a result, 80% of useful information, which could have generated alpha or caught a downside risk, gets overlookedAuquan Capital Markets are drowning in data — there is too much data and too many tools Auquan is transforming investment research using knowledge graphs to cut research time from weeks toStreamlit for teams Settings About Please wait Made with StreamlitStreamlit

Auquan Business

Auquan Business

Auquan's AI tools enable hedge funds and asset managers to turbocharge their investment workflows with datadriven insights Our Portfolio Activity Monitor helps funds deal with information overload as they struggle to find insights in 38 million terabytes of unstructured data that exists today We use Natural Language Processing and our proprietary Knowledge Graph to helpKeep scrolling for more Embed Auquan Meaning of Auquan; Backtesting toolbox for trading strategies Contribute to Auquan/auquantoolbox development by creating an account on GitHub

Auquan Williams Living In Brooklyn Ny Contact Details

Auquan Gates Auquan Profile Pinterest

Gender Unknown First Name This is the old repo, and is no longer maintained For all purposes find the new repo for the toolbox All the issues and Pull requests should be created in the new repo You can also find the new documentation here Updated Auquan Blog Search our insights Search our insights Subscribe Home Trends Using PAM to quickly form an opinion from large unstructured datasets by Chandini This case study shows how a user of the PAM platform is able to quickly investigate a new trade hypothesis by rapidly answering three main questions What does the company ecosystem look

53 Ai Solutions In Finance Chandini Jain Ceo Auquan

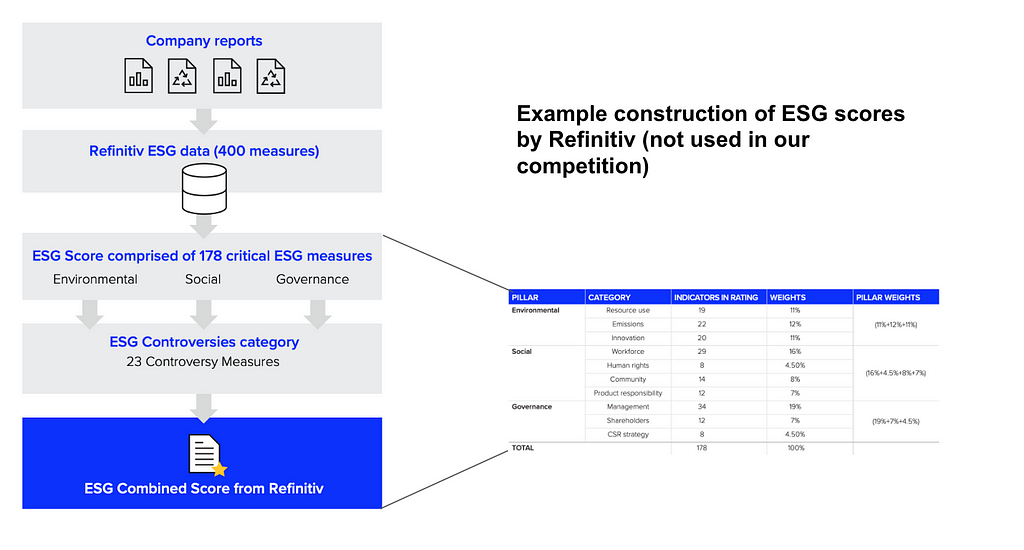

How We Think About Esg Problems At Auquan Quantquest Blog

The video demonstrates how to use Auquan's Python based toolbox for algotradingAuquan's top competitors include Quantiacs , Numerai and Wikifolio See the full list of Auquan competitors, plus revenue, employees, and funding info on Owler, the world's largest communitybased business insights platform Auquan is on a mission to translate even the most complex financial problems into fun puzzles for the best and brightest minds to solve The founders, Chandini and Shub Jain, are lifelong math puzzle enthusiasts They also happen to be veterans of both finance and tech, having worked for the likes of Microsoft, Optiver and Gusto Auquan is proving that the future of

150sec

Auquan Crunchbase Company Profile Funding

auquantoolbox 2192 pip install auquantoolbox Copy PIP instructions Latest version Released Auquan Toolbox for developing strategies and backtestingAccess to financial datasets using Auquan's toolbox Community Active chat forum and live support to help with code problems and discuss ideas How does it work? Auquan Toolbox for developing strategies and backtesting Download files Download the file for your platform If you're not sure which to choose, learn more about installing packages

Auquan Crunchbase Company Profile Funding

Auquan Email Formats Employee Phones Finance Signalhire

This is the old Auquan Toolbox, and is no longer maintained For all purposes find the new repo for the toolbox All the issues and Pull requests should be created in the new repo Get A Weekly Email With Trending Projects For These Topics No Spam Unsubscribe easily at any time Python (1,140,6) Toolbox (433) Trading Strategies (352) Quant (231) Backtesting (153) Related At Auquan, we believe that all of the world's problems should be solved using logic So, we're on a mission to convert the most complex problems in the world into fun and challenging puzzles for the best and brightest analytical minds in our community to solve The impact of this will be across every sector healthcare, transport, marketing but as a starting point, our initial focus is The latest independent research document on Global Artificial Intelligence in Trading examine investment in Market It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter The Artificial Intelligence in Trading study eludes very useful reviews & strategic assessment

Auquan Business

Auquan Angellist Talent

Auquan is the portfolio manager's data science platform Our suite of data science tools enable you to identify opportunities ahead of the market, hedge risks and save time If playback doesn't begin shortly, try restarting your device Videos you watch may be added to the TV's watch history and influence TV recommendationsAuquan is transforming investment research, using knowledge graphs, to simultaneously reduce research time from weeks to hours, while expanding the overall data coverage available to an investment team We're the first integrated research platform for capital markets that supports an interconnected central repository for external and internal data (including time series, text, AuquanDataSource Data from US stock database of 500 biggest stocks maintained by Auquan Benchmark The market instrument to benchmark your strategy's perfromancy Strategies that perform better than the benchmark are considered successful Make sure that you specify the benchmark instrumentID in list of instruments to get data for Starting

Chandini Jain Ceo Of Auquan Talks Data Science With Andy Elphick Youtube

Search Our Insights

AuquanSEIR Owner covid19hub Team name Auquan Data Science Description Modified SEIR model with compartments for reported and unreported infections Nonlinear mixed effects curvefitting Contributors Vishal Tomar , Chandini Jain LicenseAuquan is a high growth data science company operating in the fintech space and based in London, UK A graduate of Techstars 18, Auquan closed its seed round in early 19 with a plan to become the data science platform for the finance industry Currently, they serve London's institutional investors with data science and machine learning solutions to their investment problems AuquanFor the Name Auquan;

Auquan People Angellist Talent

Auquan Auquan Twitter

Aquaman (18) cast and crew credits, including actors, actresses, directors, writers and moreA quest to find the best quant See what challenges are ongoing and coming up next Be the first one to register and submit a solutionAuquan 1,872 followers on LinkedIn Transforming investment research using knowledge graphs Capital Markets are drowning in data there is too much to digest and too many tools to analyse

Uk Data Science Varsity Next Ai Incubator Community The Auquan Forum

Auquan Tech In Asia

See what employees say it's like to work at Auquan Salaries, reviews, and more all posted by employees working at AuquanAuquantoolbox v2192 Auquan Toolbox for developing strategies and backtesting PyPI README MIT Latest version published 1 year ago pip install auquantoolbox We couldn't find any similar packages Browse all packages Package Health Score 41 / 100 PopularityJob opportunities at Auquan We are building the first Data Science as a service platform for Asset Managers to discover machine learning solutions to their problems without needing an inhouse team We crowdsource accurate machine learning models from a community of 10,000 data scientists who come from some of most prestigious universities and tech companies around the

Auquan Business

完了しました Auquan Python ただかわいい犬

Auquan Careers And Current Employee Profiles Find Referrals Linkedin

Leveraging Data To Automate Trading Strategies Youtube

Auquan S Client Website On Behance

Auquan Careers And Current Employee Profiles Find Referrals Linkedin

Auquan Top Medium Publications

Auquan Delhi India Startup

150sec

Auquan Careers And Current Employee Profiles Find Referrals Linkedin

Auquan Auquan Twitter

Auquan Toolbox Python Backtesting Toolbox For Trading Strategies Pdf Stock Market Index Stocks

Auquan Secures 1 Million Seed Investment Led By Episode 1 Uk Tech Investment News

Portfolio Activity Monitor By Auquan Launch Hunt

150sec

Chandini Jain Quora

Github Auquan Auquan Toolbox Python Backtesting Toolbox For Trading Strategies Deprecated

Search Our Insights

Understanding The Code Simple Ml Strategies To Generate Trading Signal Build A Momentum Based Trading System Coursera

完了しました Auquan Python ただかわいい犬

Auquan Business

完了しました Auquan Python ただかわいい犬

完了しました Auquan Python ただかわいい犬

Auquan Holmes Hudl

Auquan Auquan Twitter

150sec

Top 7 Similar Websites Like Auquan Com And Alternatives

Quantquest Home Facebook

Auquan Finance F6s Profile

Search Our Insights

Auquan Gates Head Lifeguard Dynamo Pool Management Linkedin

Auquan Meaning Pronunciation Origin And Numerology Nameslook

Getting A Backtester Import Error Issue 18 Auquan Tutorials Github

How To Pronounce Auquan Howtopronounce Com

Auquan

Auquan Business

Working At Auquan Glassdoor

Ceo And Founder Of Auquan Chandini Jain On How One Book Helped Her Get Unbiased Feedback Reading Habits And Favorite Books

Auquan Laptrinhx

Top 7 Similar Websites Like Auquan Com And Alternatives

Auquan Careers And Current Employee Profiles Find Referrals Linkedin

Auquan S Client Website On Behance

Working At Auquan Glassdoor

Quantquest Auquan Is Partnering With Maven To Conduct A Recruitment Drive In Your Campus As A Precursor To The Process We Are Bringing You Mavens Quant Quest A Data Science

Pairs Trading Using Data Driven Techniques Simple Trading Strategies Part 3 Mathematical Analysis P Value Data Science

Auquan Angellist Talent

Auquan Business

Data Science Auquan Medium

Auquan Datalandscape

Quantquest Auquan Is Delighted To Announce That We Have Facebook

Auquan Holmes Hudl

Auquan Github

Auquan Crunchbase Company Profile Funding

Auquan Laptrinhx

Auquan

Portfolio Activity Monitor By Auquan Discover News And Investment Insights Ahead Of The Market Product Hunt

Trading Strategy Auquan Medium

Auquan Careers And Current Employee Profiles Find Referrals Linkedin

Alpha Tech Upfronts Video Know First Act Fast Miss Nothing Chandini Jain Auquan Tabbforum

Auquan Business

Auquan S Competitors Revenue Number Of Employees Funding Acquisitions News Owler Company Profile

Auquan Business

17 Ai Trading Companies Helping Investors Built In

Search Our Insights

Search Our Insights Search Our Insights Hometrends Spotting The Warning Signs Tullow Oil Case Study Manually Yes It Is Impossible To Track Information For Every Subsidiary Of Every Company At Least In A Economically Sensible Way But Data Science Can

Team Auquan Laptrinhx

Auquan Toolbox For Algo Trading With Python Youtube

Discover Emerging Trends Or Potential Risks Ahead Of Time With Auquan Youtube

150sec

Quantquest Any Team In The Auquan Cricket Challenge Who Is Part Of A Referral Chain Of Great Than 10 People Will Get Their Models Run On Data From This World Cup

Top 7 Similar Websites Like Auquan Com And Alternatives

Quantquest Home Facebook

Stream Chandini Jain Ceo Of Auquan Talks Data Science With Andy Elphick By Rise Fintech Podcast Listen Online For Free On Soundcloud

Auquan Finance F6s Profile